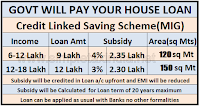

Credit linked subsidy scheme under the Pradhan Mantri Awaas Yojana (Urban) provides interest subsidy on housing loans to eligible beneficiaries belonging to the EWS/LIG & MIG segment. Axis Bank is glad

to partner with the government of India in this scheme for borrowers availing their housing loans. The

subsidy can be availed for construction or purchase of house as per the below eligibility criteria:

Note:

Household definition under EWS-LIG, MIG-I & II schemes: A beneficiary family will comprise of husband, wife and unmarried children. An adult earning member (irrespective of marital status) can be treated as a separate household.

The applicants should have an Aadhar card copy to be eligible for benefit under MIG scheme

Home extension /Repair is included only under EWS-LIG scheme, the area limit will be 30sq.m./ 323sq.ft and 60sq.m./646sq.ft of built up area for EWS and LIG category respectively.

EWS/LIG households are defined as households having an annual income of upto Rs. 3 lacs/ between

Rs.3 lacs to Rs.6 lacs respectively.

Dis c laim er:

Interest subsidy on housing loan is calculated at applicable rates for PMAY EWG/LIG/MIG I/MIG II

schemes respectively for a tenure of 20 years or the tenure of loan, whichever is lower. GOI will retain

the supreme right of granting/rejecting the subsidy and Bank will not be held liable for the decisions

taken by GOI.

The Bank may use the services of agents for sales, marketing and promotion of the Home Loan

product. Contents of this advertisement, products and services offered by Axis Bank are subject to

applicable laws and regulatory guidelines/ regulations. All loans at the sole discretion of Axis Bank Ltd.

RBI does not keep funds or accounts of any individual/public/trust. Do not be a victim to any such

offers coming to you on phone or email in the name of RBI.

FOR MORE DETAILS VISIT NEAREST AXIS BANK BRANCH

to partner with the government of India in this scheme for borrowers availing their housing loans. The

subsidy can be availed for construction or purchase of house as per the below eligibility criteria:

Note:

Household definition under EWS-LIG, MIG-I & II schemes: A beneficiary family will comprise of husband, wife and unmarried children. An adult earning member (irrespective of marital status) can be treated as a separate household.

The applicants should have an Aadhar card copy to be eligible for benefit under MIG scheme

Home extension /Repair is included only under EWS-LIG scheme, the area limit will be 30sq.m./ 323sq.ft and 60sq.m./646sq.ft of built up area for EWS and LIG category respectively.

EWS/LIG households are defined as households having an annual income of upto Rs. 3 lacs/ between

Rs.3 lacs to Rs.6 lacs respectively.

Dis c laim er:

Interest subsidy on housing loan is calculated at applicable rates for PMAY EWG/LIG/MIG I/MIG II

schemes respectively for a tenure of 20 years or the tenure of loan, whichever is lower. GOI will retain

the supreme right of granting/rejecting the subsidy and Bank will not be held liable for the decisions

taken by GOI.

The Bank may use the services of agents for sales, marketing and promotion of the Home Loan

product. Contents of this advertisement, products and services offered by Axis Bank are subject to

applicable laws and regulatory guidelines/ regulations. All loans at the sole discretion of Axis Bank Ltd.

RBI does not keep funds or accounts of any individual/public/trust. Do not be a victim to any such

offers coming to you on phone or email in the name of RBI.

FOR MORE DETAILS VISIT NEAREST AXIS BANK BRANCH